Our Services

At Debrief Accounting, we provide expert accounting and financial services tailored to support your businesses growth and success.

Whether you’re a startup, small business, or established company, we ensure your finances are well-managed, compliant, and optimised for future growth.

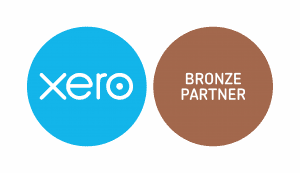

Bookkeeping

Accurate and up-to-date bookkeeping is the foundation of a healthy business. We handle:

- Sales and purchase invoice processing.

- Bank reconciliations.

- Debtor and creditor management.

Healthy business.

Financial Accounting

We prepare and maintain your financial records, ensuring compliance with regulations and giving you a clear financial picture of your business.

Management Accounts

Stay on top of your business performance with regular management accounts, including:

- Profit & loss reports.

- Balance sheets.

- Key financial insights.

Business performance.

Stock Management

We help you track and control inventory levels to improve cash flow, reduce waste, and increase profitability.

Cash Flow, Budgeting & Forecasting

Effective financial planning is essential for business success. We provide:

- Cash flow analysis.

- Budget preparation.

- Financial forecasting to support growth.

Essential for business success.

Business Consulting & Support

From financial strategy to operational efficiency, we offer expert guidance to help your business thrive. Whether you’re looking to scale up, improve profitability, or navigate financial challenges, we’re here to help.

VAT Services

We ensure your VAT compliance with:

- VAT registration.

- Quarterly VAT returns.

- HMRC submissions.

VAT compliance.

Year-End Accounts & Submissions

We manage your annual accounts and submissions, ensuring full compliance with HMRC and Companies House while helping you minimize tax liabilities.

Self-Assessments

Filing a self-assessment tax return can be time-consuming and complex. We take the stress out of the process by:

- Preparing and submitting your self-assessment tax return.

- Ensuring compliance with HMRC regulations.

- Helping you maximize tax efficiency.

Maximize tax efficiency.

© 2025 Debrief Accounting.

All rights reserved